Is there a good replacement for Quicken? Check out this list of best alternatives (including free options) to manage your money.

- Personal Capital (for Online)

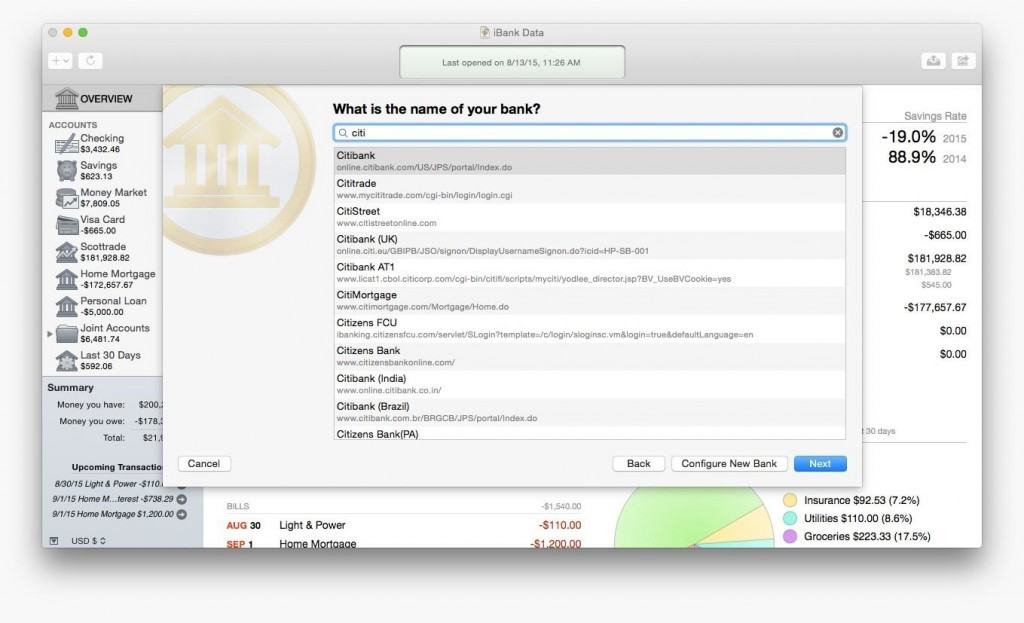

- Banktivity (for Mac)

- You Need a Budget (for iPad)

- Mint

- EveryDollar

- PocketSmith

- Tiller

- PocketGuard

- CountAbout

- MoneyDance

Here we have 24+ Best Quicken Alternatives. Quicken is a private financial management process for the Mac and windows working process customers that are headquartered on the process of double entry accounting standards and recordkeeping. Which of these Quicken alternatives work on Mac? Any cloud-based alternative will work on the PC and a Mac. It's cloud-based so they work in your browser, which makes them operating system agnostic. If you want a piece of software designed specifically to run on Macs, Banktivity is your best option. It's one of the few personal finance.

Launched in 1983, Quicken is the one of the oldest online budgeting programs on the market. But a slew of newer, cheaper programs now offer the same benefits and services.

Read on for our list of the best alternatives to Quicken.

Top Alternatives to Quicken

Most budgeting programs are now online-based, which means anyone can access and use them on any browser. However, some still have more functionality on certain platforms than on others.

Best Alternative for Online: Personal Capital

Pros

- Base service with most features is completely free

- Shows credit, bank, and investing accounts

- Features retirement goal setting

Cons

- High fees and account minimum for advisory service

- No budget creating option

How it Compares

Like Quicken, the web-based Personal Capital allow users to link all of their financial accounts, including investments.

Unlike Quicken, though, the platform doesn't allow you to create a budget. The program will break down your spending. It also offers retirement planning and investment checkups.

Once they log into their Personal Capital account online, users immediately see their investments and cash flow directly from the homepage. This overview is quicker to access than Quicken's, where users must click through drop-down menus.

Personal Capital is a good free alternative to Quicken. The money management tools are free. An advanced paid financial planning option is available to users with over $100,000 in their accounts.

Who Should Use It

- Investors who want a detailed overview of their accounts

- People with multiple financial accounts

Best alternative for Mac: Banktivity

Pros

- Made for and syncs with all of your Apple devices

- Offers bill pay

- Provides investment tracking

- Supports multiple currencies

- Costs only a one-time payment for base app

Cons

- Requires additional yearly payment for Direct Access account syncing

- Only works on newer Macs

How it Compares

Banktivity is the best budgeting app for Mac users, primarily because it is only for Mac users. The app is only available on Apple devices running at least Sierra 10.12. It syncs across all of them, storing users' data in the cloud.

The program is meant to be as comprehensive as Quicken. It offers a look at all of your investments and spending at once, though you do have to organize each charge into its own category manually. From those charges, Banktivity automatically generates suggested budgets. You can also pay your bills within the app, which supports any currency, not just U.S. dollars.

A one-time purchase of $69.99 nets you the base program for life, but if you want your accounts to automatically sync, you'll need to pay an additional $44.99 every year.

Who Should Use It

- Mac users who want a fully-integrated software and don't mind paying for it

- Mac users who want to pay bills via their budgeting app

Best Alternative for iPad: You Need a Budget

Pros

- Simple interface makes getting started easy

- Free 34-day trial

- Gives users access to wealth of resources

Cons

- Costs $6.99 per month

- No advanced investing tools

How it Compares

You Need a Budget, or YNAB, creates a budget by predicting users' expenses based on recurring payments, such as rent and utilities.

The app's budgeting plan holds users much more accountable than Quicken's software. It uses a strategy called 'zero-sum budgeting.' Every cent is accounted for, whether it goes toward groceries, rent, or savings.

YNAB also offers financial tools, such as daily webinars, to get users comfortable handling their own money. The service is an easier introduction than Quicken into the world of budgeting thanks to these features. The iPad version of the app is consistently rated high by users on the iTunes store.

Who Should Use It

- People seeking accountability in their spending habits

- Those looking to make changes and cuts to their budget

Best Modern Alternative: Mint

Pros

- Free to use

- Tracking spending and monthly payments to create a budget

- Offers investment tracking

Cons

- Often experiences errors keeping accounts linked

- Investment tracking features are limited

Just like Quicken, Mint lets users link their financial accounts to track all individual transactions. Mint categorizes each expense and creates a suggested monthly budget based on past spending.

Unlike Quicken, Mint doesn't offer bill pay through the app itself. The app's basic over-time investment chart is also less comprehensive than Quicken's extensive investing tools, which include portfolio analysis and performance reports.

Who Should Use It

- People looking to dabble in creating a budget without committing to a monthly payment

EveryDollar

Pros

- Easy to use interface

- Zero-sum budgeting accounts for every dollar's use

- Dave Ramsey's seven 'baby steps' are built in

- Free 15-day trial of paid version

Cons

- Transactions must be manually input in free version

- Paid version is expensive

- Only available in U.S. and Canada

How it Compares

EveryDollar takes a 'baby steps' approach to financial success using seven simple goals. The app uses zero-sum budgeting to makes users track every cent, even those in savings.

Since EveryDollar is solely focused on budgeting, it offers no investment tools. The basic free version does not allow users to automatically sync their transaction history, which means they must enter each individual transaction.

Who Should Use It

- People who want to curb their spending

- Those looking to set itemize budget limits

PocketSmith

Pros

- Advanced tools show expected net worth years into the future

- Basic version is free to use

- Can link to investing accounts

- Creates budget calendar that syncs to personal online calendars

Cons

- Mid-tier account level costs $9.95 per month, while highest costs $19.95

- Most in-depth versions of tools only available at highest pay level

- Free version requires manual transaction input

Free Quicken Alternatives For Mac

How it Compares

PocketSmith offers state-of-the-art tools for users willing to pay a monthly fee.

The app focuses on 'forecasting' based on their current expenses, income, and spending habits from their linked financial accounts, including investments. This forecast comes in the form of a downloadable calendar that can sync up to Google, Android, and Apple devices.

The basic, free version of PocketSmith offers 6 months' worth of financial projections at a time. This does not include automatic account syncing—users instead have to enter each transaction manually.

Paying $9.95 or $19.95 per month grants access to up to 10 or 30 years of projections, respectively.

Who Should Use It

- Budgeters planning their financial future

Tiller

Pros

- Automatically files all financial information into Google and Excel spreadsheets

- Users can customize spreadsheets to fit their needs

- Shows daily feed of all transactions, spending, and balances

Cons

- Does not support investment accounts

- Spreadsheets can be confusing to newer budgeters

- Costs $59 per year

How it Compares

Tiller Money is the ultimate budgeting service for a spreadsheet lover. The web-based program divides your finances into one of several budgeting templates. Users can also create their own templates.

Tiller offers a simpler, more direct organization system than Quicken's multiple drop-down menus. Tiller concentrates on straightforward budgeting without the extra features of some other systems. It offers no investment account tracking.

The platform is free for the first 30 days and costs $59 per year afterward.

Who Should Use It

- Those who love using spreadsheets

PocketGuard

Pros

- Can link to bank, credit, loan, and investment accounts

- Basic app is free to use

- Available as app

- Automatically builds budget suggestion based on income, goals, and bills

- Allows users to set spending limits

Cons

- Only available as app

- Advice may be too simple for advanced users

- Cash tracking and custom categories only available in paid plan

- Only available in U.S. and Canada

How it Compares

PocketGuard allows users to plan monthly budgets by tracking spending and allotting money to bills. This program creates an actual spending limit for every category based on a user's previous transactions.

Quicken does not offer this feature, instead relying on users to set their own monthly maximums.

PocketGuard also lets users set monthly sending notifications to stay on top of their money without having to open the app.

The basic account is completely free. A PocketGuard Plus account, which offers the abilities to track cash spending and create custom spending categories, is $3.99 per month or $34.99 per year.

Who Should Use It

- Anyone looking to simplify their monthly budget with straightforward tools.

CountAbout

Pros

- Can import data from Quicken and Mint

- Reflects all transactions, not just those already processed by the bank

- Free 15-day trial

Best Quicken Alternatives For Mac

Cons

- Only offers automated transaction syncing with premium paid service

- No free basic account

- Does not offer investment tracking

- Lacks advanced budgeting features

How it Compares

CountAbout is a basic budgeting tool that allows users to import data from Mint or Quicken. The free account requires users to manually enter all of their financial transactions.

Just like Quicken, the paid version automatically syncs transactions across all of a user's linked accounts. But CountAbout shows even transactions that have not yet been processed.

A basic CountAbout account, which includes everything but automated account syncing, costs $9.99 per year. A premium account costs $39.99 per year, though the app does offer a free 15-day premium trial.

Who Should Use It

- Those transitioning from Mint or Quicken who need to keep their old data.

Best Alternative with Bill Pay: MoneyDance

Pros

- In-app bill pay

- Provides investment tracking

- One-time payment

- Locally-stored data keeps users' data on one device

Cons

- Difficult to import data from Quicken

- Dashboard can feel overwhelming with too many tools at once

Unlike most other budgeting programs, MoneyDance doesn't upload your data. Your information is saved only to your hard drive—unless you choose to download the app to their phone or to sync to another computer.

The program offers advanced financial tracking and budgeting tools, such as graphing, constantly updating international currency conversion rates, and more. It also supports linking investment accounts. It also is one of the few budgeting apps that offers bill pay.

MoneyDance costs $49.99 once for lifetime access, not including updates. If user wants a newer version of the program, they will need to purchase MoneyDance again.

Who Should Use It

- Anyone wary of uploading their financial data to 'the cloud'

Goodbudget

Pros

- Uses zero-sum budgeting to account for every earned dollar

- Envelope system can help users visualize their budget

- Multiple users can access same budget

Cons

- Free version only allows one synced financial account

- No email customer support with free version

How it Compares

Goodbudget uses what it calls an 'envelope system' to help users see how much money they spend on each expense. The system works similar to zero-sum budgeting: users allot a set amount of money to one 'envelope.'

The platform doesn't restrict users from spending if they go over their allotted amount, but it does notify them. Quicken, on the other hand, trusts users to create and track their own monthly allowances.

The basic version, which only allows one financial account, is free, while the paid version, which unlocks unlimited synced accounts and envelopes, costs $6 per month or $50 per year.

Who Should Use It

- People who want to track spending in specific budget categories

- Couples or roommates who split household expenses

Bottom Line

Budgeting is a crucial step for those seeking financial freedom. Luckily, a number of apps and programs can help you build a budget that fits your lifestyle and preferences.

Most of the programs on the list offer a free trial period. Take advantage to test out their service before you commit.

Disclaimer: Opinions expressed here are author's alone. Please support CreditDonkey on our mission to help you make savvy decisions. Our free online service is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content.

More from CreditDonkey:

|

|

|

How do we keep this site running? This post may contain affiliate links, for which we may receive a referral fee. The cost is the same to you and any compensation we may receive does not affect our reviews or rankings. Thanks!

Moneyspire is a new alternative to the popular Quicken personal finance software. It allows you to keep track of all your bank accounts, credit cards, loans, investments, and other financial accounts all in one place.

Like Quicken, Moneyspire gives you the tools to keep track of all your financial transactions, calculate your net worth, keep track of bills, and budget your money. You can create detailed reports showing where your money is going and to make filing your taxes easier. It also works the same for both Windows and Mac.

Download a free 30-day trial of Moneyspire here.

Moneyspire Overview

One of the best things about Moneyspire is that they respect your privacy. You are not forced to synchronize or store your financial data in “the cloud”, unlike some of the other personal financial software out there. You can keep all your information on your own computer and it never gets stored anywhere else, unless you want it to. Moneyspire does not collect and sell your personal information. You are never forced to give your name, address, and phone number to Moneyspire.

Another great thing about Moneyspire is there is no subscription. Once you buy it, Moneyspire is yours to keep and use forever. You don’t have to keep buying it again every few years or pay for a yearly subscription. It will keep working, year after year, without losing any features.

Moneyspire works in most countries and supports many currencies, unlike some of the other major personal finance software that only works in the U.S. There are people using Moneyspire in six continents and many countries, including the United State, United Kingdom, Canada, Mexico, Australia, Germany, Japan, and many more.

Major Features

- Track Accounts

- Categorize Spending & Income

- Bill and Paycheck Reminder

- Budgeting Tool

- Reports & Charts

- Balance Forecast

- Reconcile Account Statements

- Online Banking Support

- Import From Quicken

- Print Checks

System Requirements

- MacOS 10.7.5 or later, including Sierra 10.12 (32 and 64-bit)

- Windows 7 or later, including Windows 10 (32 and 64-bit)

There is also a mobile companion app, currently available for iOS (iPhone & iPad)

Screenshots

Here are a few screenshots of the major features:

Entering Transactions

Moneyspire will work with any bank. It allows you to download transactions in QIF, OFX, QFX, and CSV formats. Moneyspire also supports Direct Connect and Online Bill Pay. You can see a list of banks that support Direct Connect here.

If your bank does not support direct connect, there are alternative methods for automatically downloading your transactions into Moneyspire.

There are four main ways to get transactions from your financial institution into Moneyspire:

- Manual – You can enter transactions manually, one at a time, into any account in Moneyspire.

- Manual Download – You can download a QFX, QIF, or CSV file from your bank’s website. Then open the file with Moneyspire and it will import all your transactions. This is a quick and easy way to get all your transactions into Moneyspire, with no extra fees or setup. This method works with almost every financial institution on the planet.

- Direct Connect – Over 1200 financial institutions support Direct Connect. This feature allows Moneyspire to connect directly with your financial institution and import transactions. It happens automatically, so you don’t have to go out to your bank’s website and download anything. Not all financial institutions support this method, but if yours does, this is a great way to keep your account synchronized with Moneyspire. (Note: Some banks and financial institutions charge a fee for Direct Connect. This fee has nothing to do with Moneyspire. Your financial institution decides whether to charge this fee.) To see a list of which banks and financial institutions support Direct Connect, click here.

- Moneyspire Connect – This method supports over 9,000 financial institutions and is like Quicken’s Express Web Connect. It allows you to download transactions from your financial institution automatically over a secure internet connection instead of having to manually download them yourself. Moneyspire Connect is perfect for people whose bank doesn’t support Direct Connect. This is a yearly subscription service for those who want to download transactions automatically from banks that don’t support Direct Connect. You can see a full list of supported institutions and learn more about the service here.

(Note: Moneyspire Connect is an annual subscription for those who want automatic transaction downloads. It is not required to use Moneyspire. You will always be able to download and import transactions from your financial institution manually with a QFX, QIF, or CSV file without any extra fees or subscriptions.)

Moneyspire Cloud

Moneyspire Cloud is a free service that allows you to share data between several computers and mobile devices. Setup is quick and easy within the Moneyspire program. Once it’s set up, your data will be synchronized with the cloud, allowing you to keep all your data updated across multiple computers. You can even install Moneyspire on a Mac and a PC and your data will stay in sync.

My Impressions of Moneyspire

I found Moneyspire to be a solid, reliable program for tracking personal finances. It is not quite as full-featured as Quicken Premier or Quicken Home & Business, but it is an excellent program for keeping track of bank, credit card, and loan accounts.

Because of its simplicity, Moneyspire is easy to use and very fast. It imported transactions from my bank accounts without any problems.

One of the most impressive things about Moneyspire is that it was able to import my huge Quicken data file. I imported 38 accounts and thousands of transactions from 2004 to 2017 and it worked flawlessly in Moneyspire. (See this article for steps.)

Moneyspire comes with plenty of built-in categories, but I was able to easily create new categories as needed.

The reports are easy to generate and customize to exactly what you need to see.

The budgeting tool is simple and easy to use, without an overly complicated display. It shows exacly what you have budgeted for each category and what you have spent so far.

The only thing I didn’t like about Moneyspire is the accounts list on the left side of the program does not sort accounts by type. It is a big list in alphabetical order. I would prefer the Quicken way of sorting accounts by type, so the checking accounts are all together, credit card accounts are together, assets are together, and so on. This is a minor annoyance, but worth pointing out as a feature to add in the future.

I would also like to see the following features in a future update. These features would make Moneyspire even better:

- The ability to tag transactions and create reports using tags. This would be very helpful for tracking expenses for a business or another specific purpose.

- A report to show investment performance.

- For investment accounts, it currently shows the cash balance. It should show the balance including the value of current investments and cash.

Summary

If you need to keep track of your bank and credit card transactions, Moneyspire is excellent. You can also use it to track loans and assets (such as a home, car, etc). It doesn’t have robust investment tracking tools like Quicken Premier, nor does it have a lot of business tools. But for everything else, Moneyspire does the job simply and elegantly.

If you are looking for a good personal financial management program or are looking for an alternative to Quicken, I highly recommend giving Moneyspire a try.

You can get a free 30-day full-featured trial of Moneyspire here (no credit card required).

If you’re ready to purchase Moneyspire now, you can get it right here. I recommend the Basic Edition for most people. It includes everything most people need. Moneyspire comes with a 60-day money back guarantee, so even after you buy the software, you can still try it for another 60 days with no risk.

Nate Phillips has been using Quicken and TurboTax for almost 20 years. He has spent part of that time as a Quicken beta tester, helping identify bugs and annoyances with Quicken updates before they are released. Nate holds a master’s degree in Computer Science and has numerous technology certifications.